Gemini Review

-

Account Set Up Process

-

Available Tools

-

Ease of Use

-

Fees

Summary

Gemini is a one-stop-shop for most retail crypto investors. They have taken extra steps in the financial compliance world, and they provide an extensive list of assets to purchase and sell. They make it very easy to Dollar Cost Average purchases, so long-term investors can set it and forget it.

Their trading fees are right in line with the consumer platform market, but could be cost-prohibitive for day traders.

Pros

- Direct Purchase With Fiat

- Dollar Cost Average

- Staking (Earn)

- Large Token Options

- Industry Regulated

Cons

- Fees on Large Transactions

- Credit Card Waitlist

The Gemini cryptocurrency exchange is arguably one of the largest and most successful US-based exchanges at the moment. Since they first came on the scene, they have moved quickly to create one of the most robust platforms and extend their service offerings well past just a place to buy and sell Bitcoin and Ether.

Gemini Introduction

Gemini was founded by Cameron and Tyler Winkevoss, and officially launched as a platform in 2015. What set them apart from the beginning was their emphasis on following many of the traditional financial sector rules, such as getting official licenses to deal in Ether and Zcash. They were established as a New York trust company, and operate under the regulation of the New York State Department of Financial Services.

Their desire to start the business from a regulated position drew criticism from some of the original adopters of cryptocurrencies, but their decision to do so has added a level of trust in their business that didn’t exist with many of their competitors. By “following the rules” and establishing official avenues for managing and storing their customers assets, they quickly rose to a position of prominence among the mainstream adopters, and later, institutional investors.

While their dealings on the institutional side is vast (relatively), the focus of this Gemini review will be on the consumer side.

Account Set Up

The onboarding is very simple, and the system walks you through everything needed immediately after registering with the site. An added bonus is you can skip the identity verification process if you do not want to give away all your personal info before taking a look at their dashboard. However, you will be unable to transfer any money into your account, or make any trades.

Set Up Instructions

- Register here

- Confirm your email address

- Set up your two-factor authentication with a phone number or app

- Add your bank account

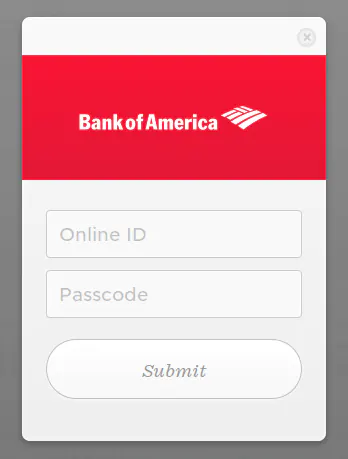

When adding a bank account, Gemini uses a process similar to Coinbase and BlockFi that allows you to automatically log in to your bank and immediately connect. This process will be familiar for anyone that’s used recent financial software that links directly to their bank.

If you haven’t used this method of verification before, rest assured it is pretty safe. The information does not go directly through Gemini, so they do not get a copy of your log in information. If you prefer to do it the old-fashioned way with a few small deposit verifications, that’s an option as well. Just be prepared to wait a few days before the account is linked.

Identity Verification

In order to unlock your entire account, you will need to provide the following information:

- Full Name

- Password

- Address

- Social Security Number

- Proof of Address

- Identification

Gemini Available Tools

There are three primary services that Gemini offers to the general public, a trading account, earning account and a crypto credit card.

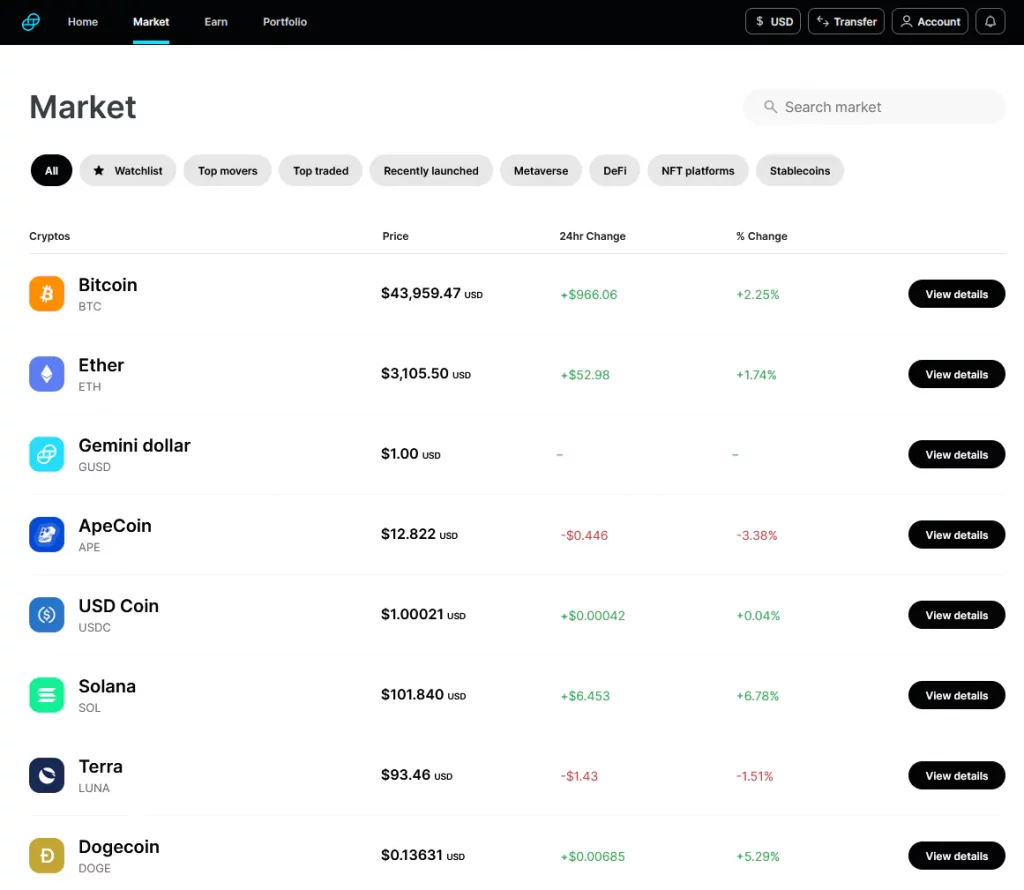

Trading Account

The Gemini Trading Account is the primary service you get when you sign up with them. It gives you access to buying and selling, in real-time, the dozens of cryptocurrencies Gemini has on their platform. At the time of this review there are 81 tokens available to buy and sell, and that number is constantly growing as new coins become popular.

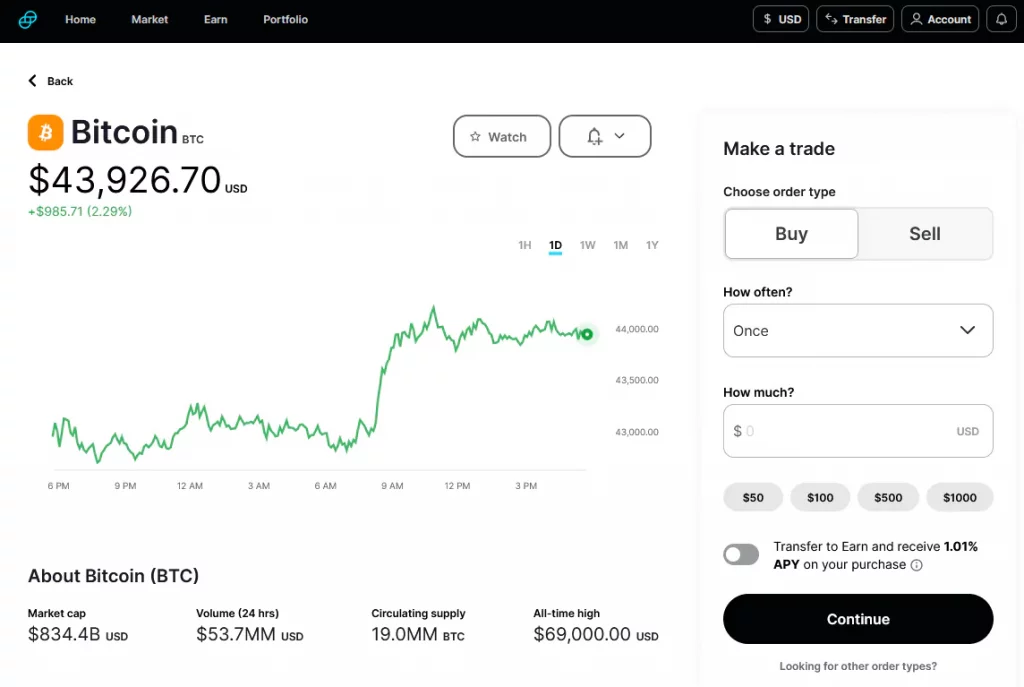

Buy/Sell

Buying and selling is very straightforward within the Trading Account. You simply click on the coin you want to interact with and it brings up the overview. Within the overview you have a number of options:

- Buy or sell

- Add to your watch list

- Set price alerts

- Set up automatic buys

- Transfer purchase to your Earn Account

While many of these features exist on other platforms, Gemini does a very good job of bringing them all together in one place. The automatic buy is a great feature for investors that prefer to dollar cost average their purchases.

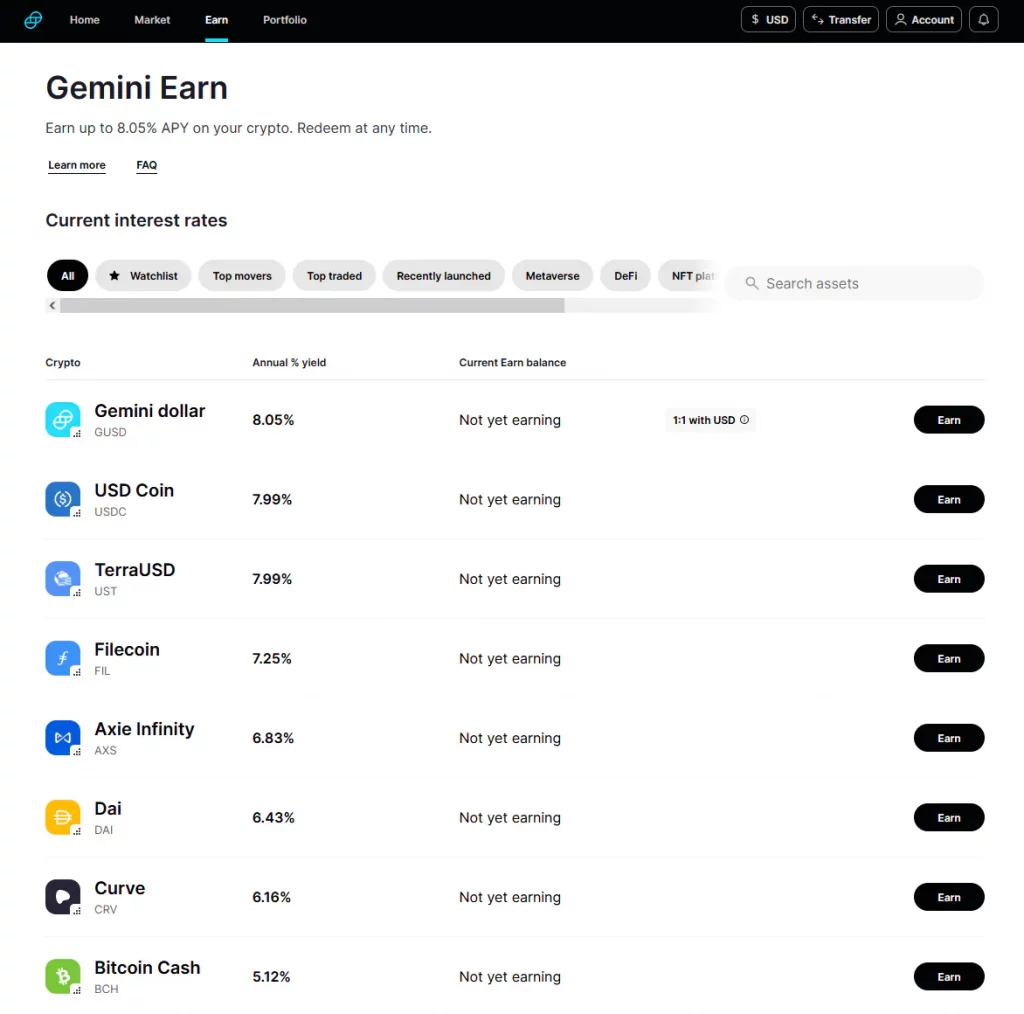

Gemini Earn

The next tool available is a Gemini Earn account. Similar to BlockFi, the Earn account lets you earn interest by loaning out your crypto to institutions. The amount you can earn depends heavily on the token, and the rates fluctuate frequently. The higher the demand for the particular coin, the more you could potentially earn for loaning it out.

At the time of this writing, there are 45 coins that can earn interest. The highest APY currently is on Gemini’s own stable coin, the Gemini Dollar (GUSD). The current yield is 8.05% but that is subject to change.

Warning: It is important to understand that you are loaning your assets out in exchange for an interest payment. This is not like an FDIC insured bank account that is backed by the US Government. If something goes sideways in the market, or the borrows are unable to pay, there is a risk of losing your principle investment.

While we are talking about it, its a good time to discuss the Gemini Dollar stable coin. While there are a number of stable coins on the market, The Gemini Dollar, along with the USD Coin (USDC) have some of the strongest backings by the organizations that run them. The Gemini Dollar, for example, is fully backed 1:1 and is regulated as well as insured. You can read more about GUSD here.

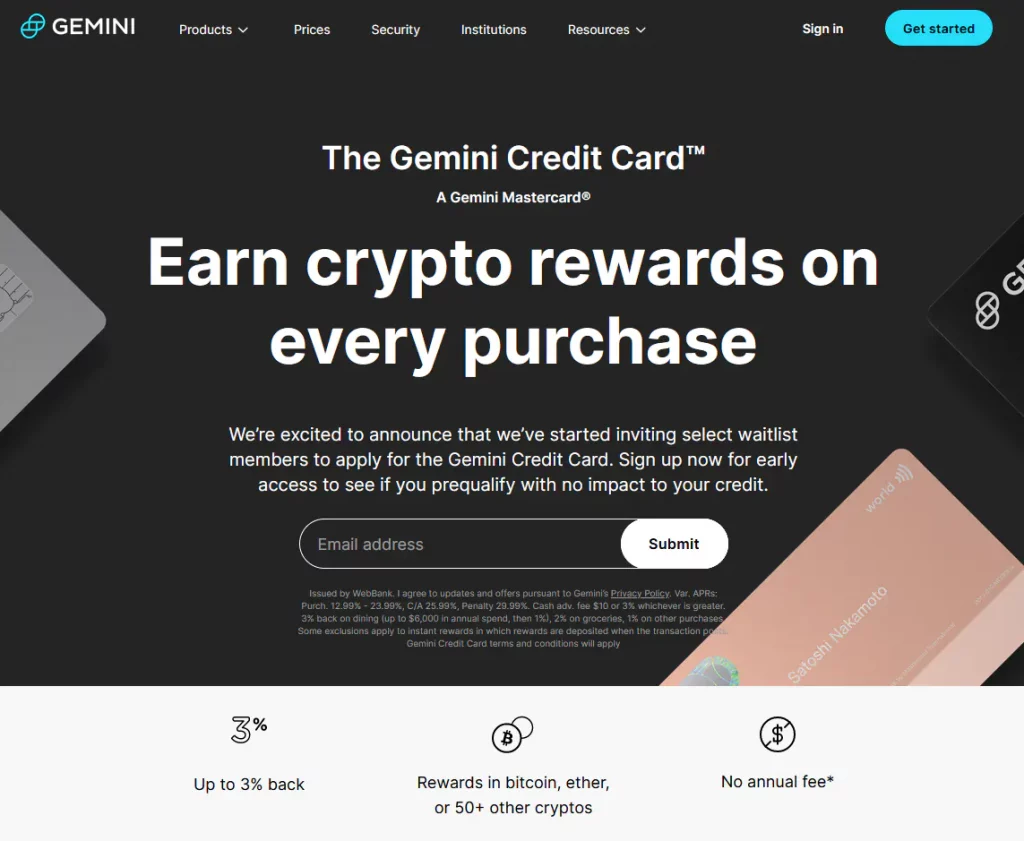

Gemini Credit Card

Similar to BlockFi’s cryto card, Gemini also offers their own version of a rewards credit card. The basic premise is the same; as you spend on the credit card you receive your choice of crypto back like a cash back card. These coins are automatically deposited into your Gemini account.

While the overall premise is the same, the details are different. The Gemini Credit Card is a Mastercard, and the payout categories differ. Similar to many point and cash reward cards today, this one has different categories that earn differing amounts of rewards. The current category breakdown is as follows:

- 3% – Dining (up to $6000 a year)

- 2% – Groceries

- 1% – All other purchases

The card currently has a waitlist, so you are unable to sign up immediately. For more information about getting on the list, as well as it’s other benefits, click here.

Gemini Fees

Gemini offers services for both retail investors and institutions, so their fee schedule is fairly difficult to navigate. The primary fees a typical website user will be facing are highlighted below. For a full list of up-to-date fees, make sure to check out their website.

Web and Mobile Trading Fees

Gemini has separate policies about trading on the website vs. trading on their mobile app, but the pricing is currently the same. When making a trade on either system, there is currently two fees you will pay:

- Convenience Fee

- Transaction Fee

Convenience Fee

The Convenience Fee currently equates to 0.50% of each transaction. So the cost of this will scale up and down with the amount of the order.

Example: A $1000 buy order will have a Convenience Fee of $5.

Transaction Fee

Each transaction also carries a Transaction Fee that is based on the amount of the trade. It scales up in price to $200, then becomes a percentage. Here is the chart:

| Trade Amount | Transaction Fee |

| Under $10.00 | $0.99 |

| $10.01 – $25.00 | $1.49 |

| $25.01 – $50.00 | $1.99 |

| $50.01 – $200.00 | $2.99 |

| $200.01+ | 1.49% of Value |

Fee Examples

The total fee for each transaction will be the sum of the Convenience Fee (CF) and the Transaction Fee (TF). Here are a few examples:

Example 1: $30 transaction = $2.14 fee ($0.15 CF + $1.99 TF)

Example 2: $500 transaction = $9.95 fee ($2.5 CF + $7.45 TF)

Gemini Final Thoughts

Gemini is a robust platform that has a lot of great features. Anyone just starting out, or looking for a custodian for their crypto portfolio will find a good home with Gemini. Someone coming from a traditional market investment background will enjoy the ability to Dollar Cost Average (DCA) into their preferred coins.

If you are a day trader, or plan on being very active, Gemini’s consumer platform may not be the best solution due to their fee structure. While it is perfectly in line with similar services like Coinbase, its not a great spot for people doing a lot of trades.

Overall, the vast majority of users will find their consumer platform to be very sufficient. Combined with their extra regulatory efforts, its a good choice.