Coinbase Review

-

Account Set Up Process

-

Available Tools

-

Ease of Use

-

Fees

Summary

Coinbase is one of the heavyweights when it comes to cryptocurrency exchanges. They were one of the first to allow US citizens to buy directly using their bank accounts and credit cards, and have since expanded into multiple countries (including most of Europe).

They offer tools that can help you dollar cost average (DCA) into your positions, as long as you live within a supported country. Coinbase has also signaled they will allow for ETH staking sometime in early 2021.

Pros

- Direct Purchase With Fiat

- Dollar Cost Average

- Staking/Rewards

- Established Brand

Cons

- Offline During High Volatility

- Support Response Time

- Fees on Large Transactions

Coinbase is one of the most recognizable brands in the cryptocurrency exchange industry. They were one of the first businesses that streamlined the purchase of Bitcoin and Ether with fiat, and have since expanded to support dozens of digital assets. This Coinbase review will cover its account set up process, fees, customer service, and ease of use.

Coinbase Review Introduction

Founded in 2012 by Brian Armstrong, Fred Ehrsam and Ben Reeves, Coinbase quickly rose to prominence in the cryptocurrency space, since the methods for buying and selling Bitcoin at the time were very cumbersome and not very transparent.

Coinbase is based out of San Francisco, California, but operates (or provides services) in over 100 countries. The services available vary depending on the locale. In the US and much of Europe, users are able to buy cryptocurrencies directly with fiat (like US Dollars).

While not every service is available in each country, you can find a list of current capabilities by country here.

Brian Armstrong currently serves as the company’s CEO, and the platform boasts having over 40 million verified users.

Account Set Up

Setting up your account with Coinbase is very straightforward, just expect it to be a few days before things are fully established and everything is connected.

In order to fully unlock Coinbase’s features, you will need to verify your identity as well as link a bank account and/or credit card. This is perfectly normal, since we are talking about financial transactions taking place.

Be prepared with a Drivers License or Passport, as you will need to upload photos of them so they can verify the information you provide.

The full process looks like this:

- Create an Account

- Verify Your Email

- Verify Your Phone Number

- Add Personal Information

- Verify Your Identity

- Link Your Payment Methods

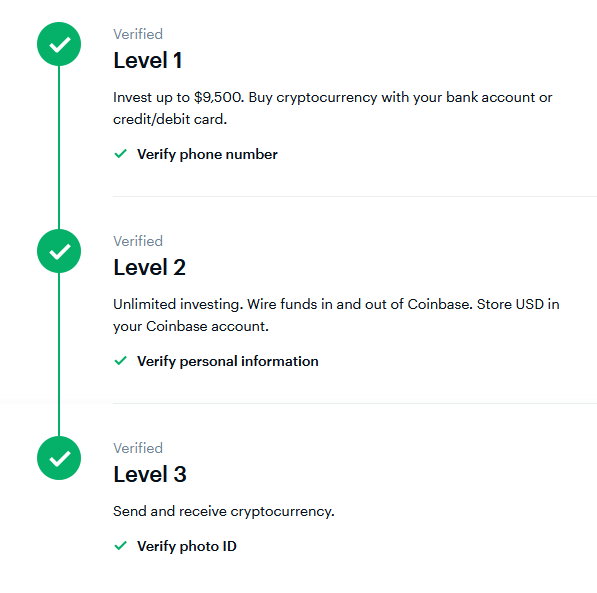

Verification Levels

In order to maximize your buying, selling and transferring capabilities, you are required to verify different levels of your identity. This is a requirement for any reputable cryptocurrency exchange due to Know Your Customer (KYC) laws in the United States (other countries may have their own requirements as well).

While it might feel invasive when initially establishing an account, its important to remember that any bank would require similar information before allowing use of its services.

You will be unable to send or receive cryptocurrencies into or out of your Coinbase wallets until you submit your photo ID (Level 3).

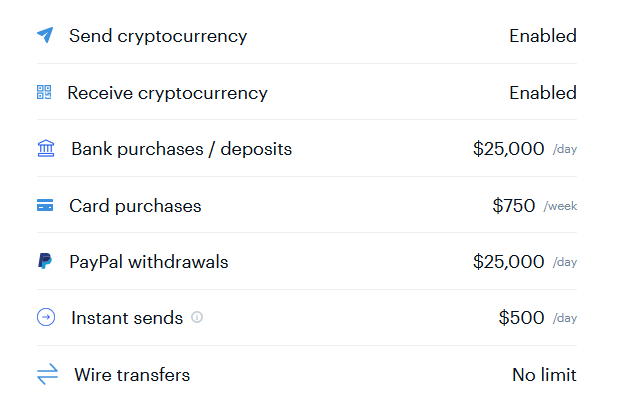

Account Limits

Once you are successfully verified in their system, your activity limits are raised. Coinbase has default limits for verified accounts. Depending on transaction history and account standing, it may be possible to increase those limits by reaching out directly to Coinbase.

It should be noted, however, that anyone doing large volumes of buying, selling or trading should check out Coinbase’s real time exchange, Coinbase Pro.

Coinbase Pro has different fees, limits and withdrawal/deposit maximums.

Coinbase Available Tools

As one of the leaders in the exchange space, Coinbase has built out a lot of tools and features within their platform.

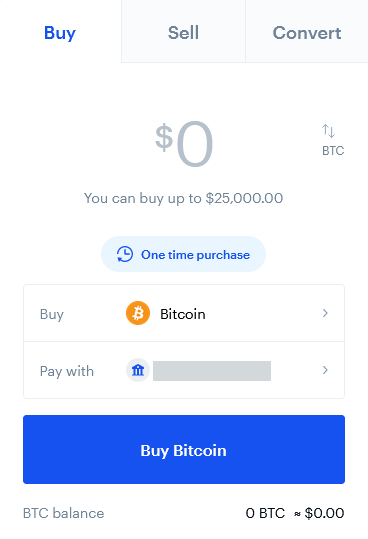

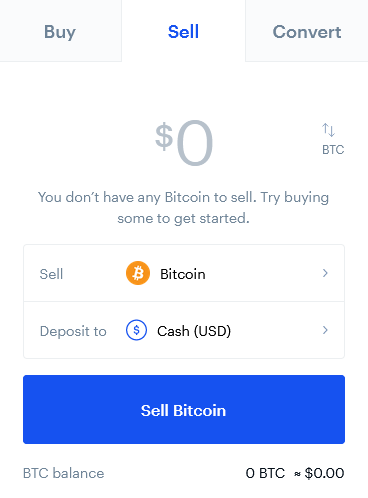

Buy / Sell / Convert

Once your account is fully activated and verified, you have the ability to buy, sell and convert.

The buy process is straight forward. You select the digital asset you want to buy, the payment method, and choose the amount.

Once the transaction is approved, there may be a holding period while the funds are being withdrawn. That means until the everything has cleared you will be unable to move your new cryptocurrency. Since banks move pretty slow and crypto is practically instant, Coinbase needs to make sure they get their money before handing over the goods.

Coinbase does allow up to a certain threshold to be moved instantly when purchasing with a bank account. This limit is generally $500 on a fully verified account. The remaining balance will be on hold until the payment clears.

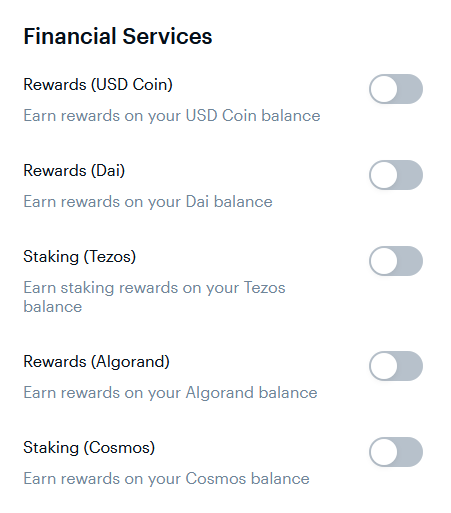

Staking and Rewards

As of press time, the cryptos you are able to earn rewards or stake on their platform include:

- USD Coin (Coinbase’s Stable Coin)

- Dai

- Tezos

- Algorand

- Cosmos

- Ether

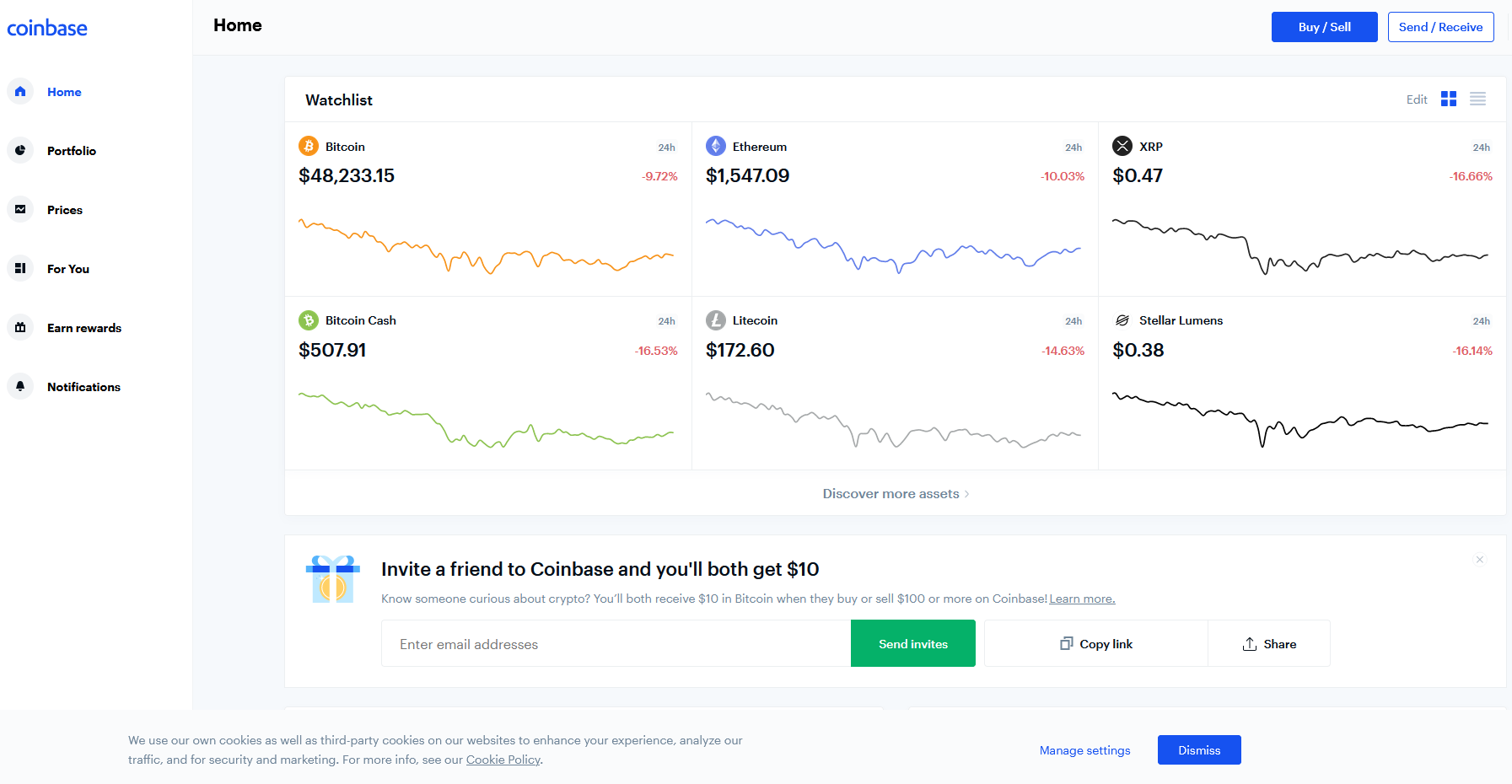

Ease of Use

Coinbase’s platform is fairly easy to use, but wouldn’t put it at the top of the list in terms of intuitively designed. It has come a very long way since its inception, however, when the platform was fairly clunky and a lot of settings were buried on obscure pages.

The current layout is pretty self-explanatory, but cluttered with things some people will not find very useful.

For example, the For You section on the left sidebar provides very limited news and events going on in the crypto world. While some people may find this useful, many folks probably prefer to get their news from an actual news source (or unfortunately, social media).

One frustrating aspect to Coinbase’s interface is how quickly they log you out.

The time before having to log back in is very short. That being said, it seems to be a common trait for many exchanges, as they really lean on the security side of things.

What’s interesting is Coinbase Pro doesn’t have the same type of issue with the log out timer. You can stay logged in for hours on their trading platform.

Another frustrating part of Coinbase’s platform is their reliability when crypto prices are highly volatile.

It is well known in the crypto community that Coinbase’s entire platform often goes offline during times of huge volatility. For those that choose to hold their coins long term, this isn’t going to be much of an issue. However, those that may be inclined to capitalize on quick price drops may want to find a backup place to make those transactions.

Coinbase Fees

While Coinbase makes it easy to buy cryptocurrencies like Bitcoin and Ether, their fee structure is a little complicated.

The first thing to understand is that Coinbase’s main retail service makes purchases on your behalf through their separate trading platform, Coinbase Pro. They add what they call a margin, or a spread, to the exchange rate. That means that when you make a buy order (or sell order) on their primary retail platform, they mark it up slightly. According to Coinbase, the spread is generally around 0.5%.

Second, there are flat fees added to the transaction depending on the amount being purchased or sold.

Here is the breakdown US pricing:

| < $10 | $0.99 |

| $10 – $25 | $1.49 |

| $25.01-$50 | $1.99 |

| $50.01-$200 | $2.99 |

| $200.01+ | 1.49% |

Notice the percentage of the transaction when going over $200.

So for transactions over $200, you can expect to pay about 2% of the total amount with the flat transaction fee and spread (or margin).

Credit Cards are charged 3.99%, presumably to cover the added risk on their part regarding potential charge backs.

Finally, ACH transfers directly from your bank account are free. Wire transfers cost $10 (in) and $25 (out).

These fees are in line with their primary competitors, like Gemini.

Coinbase Review Final Thoughts

Coinbase is a great exchange to get your feet wet, or to make periodic purchases to buy and hold. One of their best features is the ability to Dollar Cost Average (DCA) purchases, just like a 401k at work.

People looking to make large purchases or sales may be turned off by the fees Coinbase charges on large transactions. An alternative is using Coinbase Pro directly, which comes with lower fees.

Day traders will not find the retail Coinbase service particularly attractive. The processing time is too slow, the spreads are too wide, and the fees will eat away at gains. Those looking to day trade should look at Coinbase Pro, or other services by competing exchanges.