BlockFi Review

-

Account Set Up Process

-

Available Tools

-

Ease of Use

-

Fees

Summary

BLOCKFI FILED BANKRUPTCY IN NOVEMBER, 2022. THIS REVIEW REMAINS FOR HISTORICAL PURPOSES ONLY

BlockFi was one of the original major platforms to offer Interest Accounts (earn on crypto) and later a premium credit card that offers 1.5% back in crypto.

While their Interest Account has lost favor in the US due to ongoing regulatory issues, BlockFi is still a good option for people looking for a trustworthy custodian of their crypto portfolio, and those wanting a cash loan using crypto as collateral.

Pros

- Direct Purchase With Fiat

- Credit Card Rewards

- Crypto Loans

- Extra Security

- Fast Customer Service

Cons

- No US Interest Account

- Declining Interest Rates

- High Withdrawal Fees

BLOCKFI FILED FOR BANKRUPTCY IN NOVEMBER, 2022 AFTER THE FTX EXCHANGE FALLOUT. THIS REVIEW IS NO LONGER ACCURATE. IT REMAINS FOR HISTORICAL PURPOSES.

BlockFi is a relative newcomer to the crypto space, and is one of the heavyweights in DeFi lending, which is built atop of Blockchain technology. Their savings and lending products are cutting edge in the world of crypto.

Introduction

Founded in 2017 by Zac Prince and Flori Marquez, BlockFi’s mission is to provide fiat banking-like services in the cryptocurrency space. in 2018 the company began loaning fiat cash using people’s cryptocurrencies as collateral. Individuals were able to transfer their Bitcoin, Ether, and other currencies to BlockFi, who when then loan them fiat based on the value of their portfolio.

As BlockFi’s platform evolved, they began offering other services such as savings accounts for people to earn interest on their cryptocurrencies. The interest rates were, and still are, substantially higher than traditional and online bank accounts.

The crypto savings account became one of the first ways someone could earn actual returns from their holdings, rather than just relying on the underlying asset value rising.

Blockfi Account Set Up

Setting up an account with BlockFi is surprisingly simple, so long as you live in an area that they service. As a licensed and regulated financial service provider based out of New York, BlockFi operates is most countries around the world, besides countries that the, “United States embargoes goods or imposes similar sanctions.“

Examples of countries where BlockFi does not operate are Cuba, Iran, North Korea, Sudan, Syria, according to their Terms of Service.

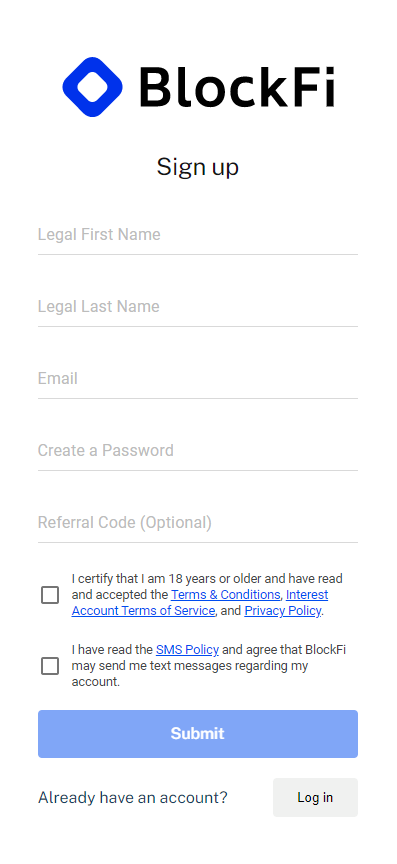

Create Account Process

For US and other supported countries, its one of the easier and intuitive crypto businesses to establish an account with. In fact, of all the fiat-to-crypto services we have signed up for, they are one of the few that we were able to complete the process the same day.

After creating your log in you are prompted to fill out the rest of your profile. Be prepared to give them the following information:

- Address

- Phone Number

- Social Security Number (US)

- Drivers License or Passport

After filling in your personal information, you will need to upload photos of your Drivers License or Passport to verify you are you.

One of the best things about BlockFi’s on-boarding system is they use a 3rd party that can verify your ID automatically in many cases. That means you may not have to wait for an actual human to review your submitted photos to verify it is you.

Anyone who has set up crypto exchange accounts during huge bull runs knows how long the wait can be. Often times measured in weeks, manual reviews can keep you sidelined. BlockFi has done a good job at fixing that issue.

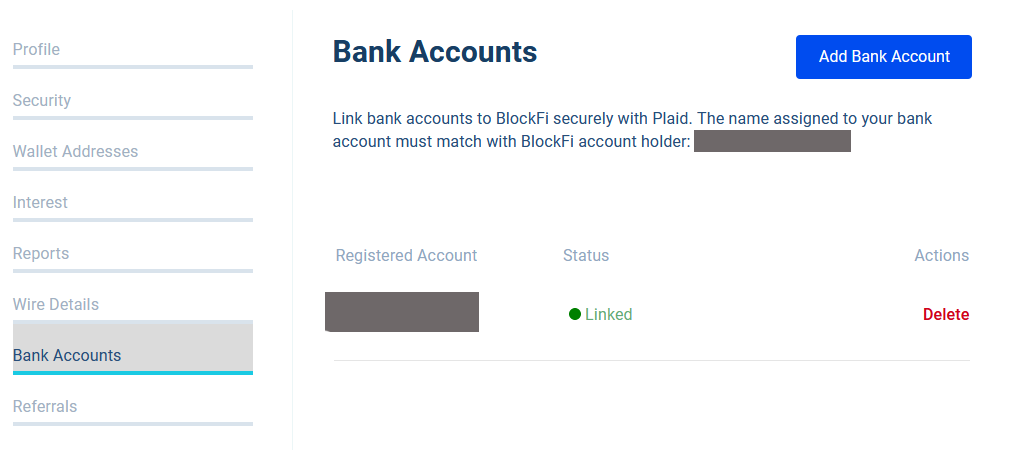

Adding Banks for ACH

To add a bank connection to your BlockFi Account, Go to Settings > Bank Accounts:

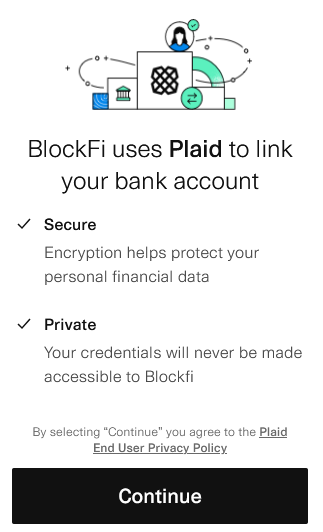

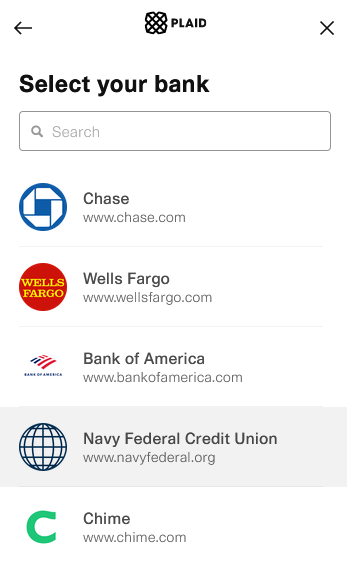

Blockfi uses a service called Plaid for simple onboarding. Plaid is a 3rd party tool that connects directly to your bank using your bank log in. It eliminates to old method of submitting routing and account numbers, waiting for deposits, then verifying the amounts a few days later.

By utilizing Plaid’s connection tool, it eliminates the need for BlockFi to store any of your personal log in information for your bank.

After selecting your bank and logging in, you can choose which account to link to BlockFi. Once confirmed, you can use the ACH function within their platform to move cash on and off the platform.

It should be noted that BlockFi does not actually hold onto cash. Any cash transferred into their platform is converted to GUSD. You can read more about GUSD here.

BlockFi’s Available Tools

Despite their fairly new status in the crypto world, BlockFi has created a robust set of tools for their users.

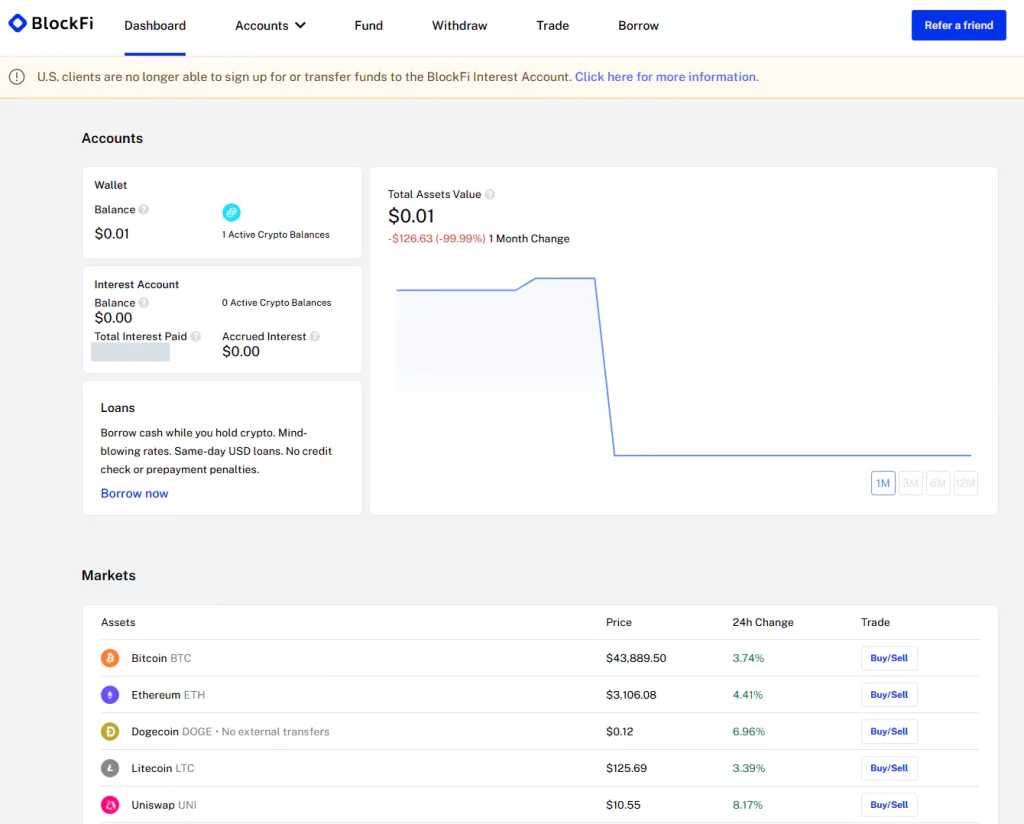

Buy/Sell

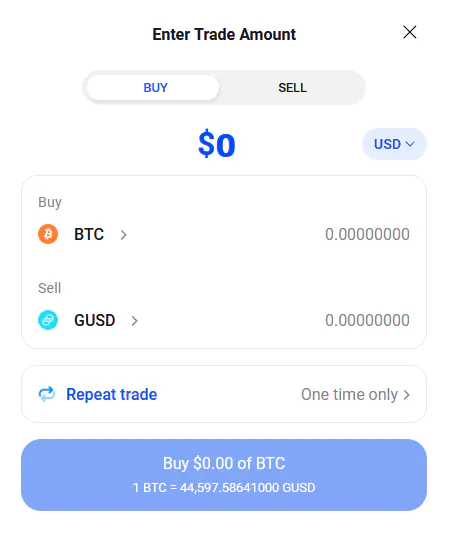

Looking very similar to the Coinbase UI, the BlockFi platform makes it pretty simple to simply buy or sell the cryptos they deal with on their site. After linking a bank account, you simply select the item you wish to purchase and the amount to be issued. If you currently have stable coins in your wallet, you can also select those as a funding option.

The process of selling is just as easy. By selecting the Sell option on the trade window, you’re presented with a very similar interface as the Buy side. When selling you also have the option of converting your crypto to a stable coin, or transferring the funds directly to your connected bank account.

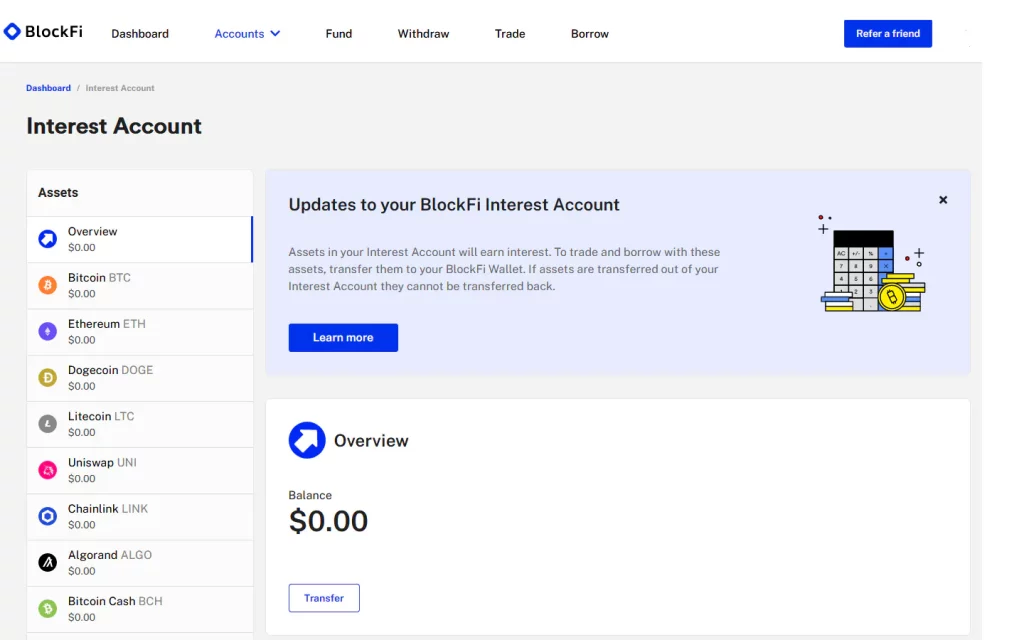

BlockFi Interest Account

The BlockFi Interest Account was perhaps the single most important feature that put their platform on the map. Crypto that you keep in your Interest Account, actually earns interest. In the beginning, the interest rates were quite high and there were not any caps on how much you could deposit. Now those rates have come down on many of the coins, and most have caps that limit the amount you can earn.

Warning: They are not paying you interest simply because they want to be nice. They are loaning out your crypto to organizations who are taking out crypto loans. Its very similar to how a bank operates with your savings account, but with much less government oversight and protection.

Note to US Citizens: BlockFi made it’s name with this product, especially in the US. Unfortunately, doing to ongoing legal debate with the US Government, they have suspended all further deposits into US-based Interest Accounts. Any crypto already in the account will continue to earn, but once it comes out it can’t go back in. The word is they are working on the legal framework to relaunch a similarly-featured product for US Citizens at some point, but there is not final date on that. You can read more about it here.

BlockFi Loans

The flip side to their Interest Account is their Loan service. Anyone with a reasonable amount of cryptocurrency can use the Loan platform to get an asset-backed loan.

How does that work? By locking up your crypto with BlockFi, you can quickly get a cash loan that uses your assets as collateral. That means you will not be able to access your crypto until your loan is paid back, but the approval process is very simple because they can immediately verify your ability to pay back the loan.

An important note about these types of loans is they come with a loan-to-value (LTV) metric that is closely monitored by BlockFi. This represents a percentage of your initial crypto deposit that the value must maintain before BlockFi liquidates your collateral.

Here is an example in English:

If you deposit $100,000 worth of Bitcoin and use it to get a $50,000 cash loan with an LTV of 60%, that means BlockFi will sell your Bitcoin if the initial $100,000 worth drops 40% to $60,000. With crypto markets as volatile as they are, this is always a risk.

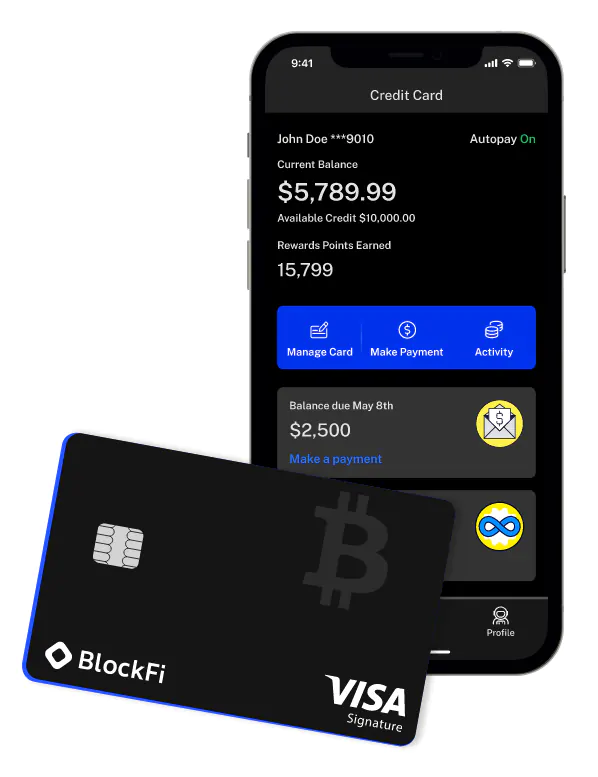

BlockFi Rewards Visa Signature Credit Card

While the Interest Account and Loans services got BlockFi out of the gate, their rewards credit card earned them a pretty big following. The headline feature of this card is earning 1.5% back in crypto on all your purchases. There are some other ancillary perks that come and go, such as trading and spending bonuses, but their “crypto back” on purchases is certainly the fan favorite.

While the card itself isn’t as rewarding as a typical 2% cash back card, its still a pretty popular product for crypto enthusiasts. The classy Bitcoin logo on the front doesn’t hurt either.

Since it has a fixed 1.5% back, its different than the tiered rewards card issued by Gemini.

Ease of Use

BlockFi is very easy to use, and in most cases will make a typical bank website seem clunky. They have done a good job at making their interface very user-friendly, and communicate through social media and emails a lot (perhaps too much sometimes).

There is one issue that a lot of people seem to get hung up on with BlockFi, and that is withdrawing crypto to a separate wallet. Most exchanges and wallet apps are designed to move crypto very fast, based on the speed of the underlying blockchain. Since BlockFi was not created to be an exchange or a wallet (in the beginning), they take a different approach to security and how crypto moves out of their system.

Withdrawals are submitted by the user, then verified by BlockFi before they are approved and sent. This means that withdrawals can sometimes take days to finalize. While this may be a pain when trying to move something quickly, it does add a layer of security that other platforms do not have.

One way to speed up the process is to add specific wallet addresses to your Whitelist. The downside to having whitelisting enabled is if you do want to send crypto to another address, you better plan on at least a week before that will happen. Again, extra security measures.

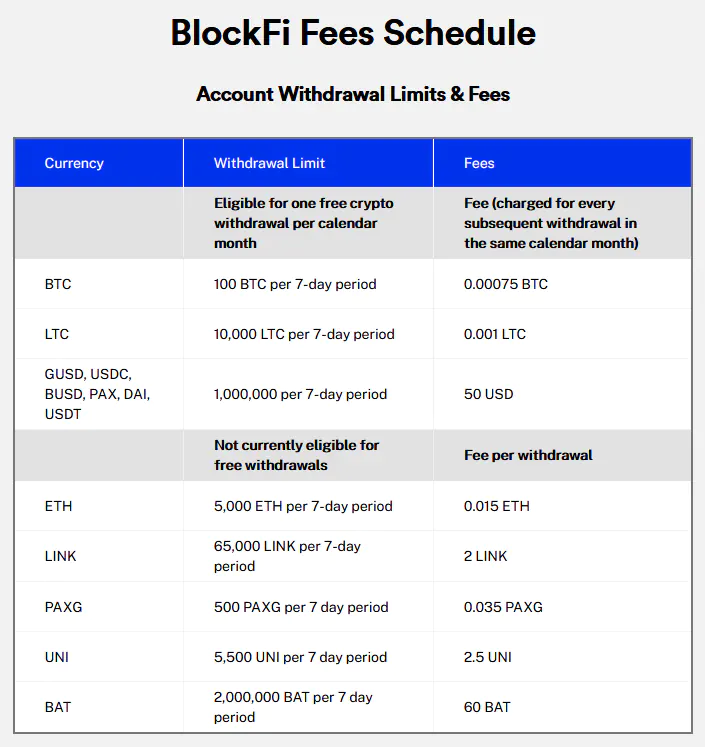

Fees

BlockFi doesn’t charge a trading fee per se, but they do operate using a buy spread of around 1%. This is opposed to a full-fledged exchange like Coinbase Pro that would charge a percentage fee of the trade, but doesn’t pocket the spread cost.

Since BlockFi isn’t a day-trading type exchange, the typical user isn’t going to be impacted that much by the spread fee. Where they may run into issues is regarding their flat-fee withdrawal structure. As of this BlockFi review, these were the fees:

You may note that ETH does not come with any free withdrawals, and cost 0.015 ETH for each. With a $3000 ETH price, that equates to $45 USD per withdrawal. With the advent of NFT’s, there have been some wild swings in ETH gas prices, but at this moment it costs $0.13 to send a Level 1 transaction on the Ethereum network, so $45 seems completely unreasonable.

BlockFi Final Thoughts

Without a doubt, BlockFi spent its time in the sun as one of the crypto darlings. Unfortunately, with multi-year downward pressure on their interest rate payouts, followed by an all-out stoppage of new Interest Accounts for US Citizens, what set them apart has brought that back in line with most of their competitors.

If you are security conscience, they score extra points for the added layers of withdrawal. If you’re looking for speed, they likely lose points in that department. Their credit card stands out as one of the premier crypto cards, and that along with their loan program may be what continues to drive them forward until they can re-launch a version of their Interest Accounts.

If you are looking for a custodian that you can build a portfolio with, BlockFi is a great choice. Their added security and credit card options are great additions. If you plan on sending transactions frequently using your wallet, their fee structure is not very favorable.